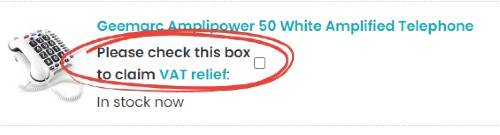

| VAT ReliefVAT Relief - Information and Exemption FormsMost items on Amplified Telephones.co.uk are available zero rated and therefore free from VAT (Value Added Tax) at the current rate of 20%. The product description will normally state whether the product is available free from VAT, but if there is any doubt or you would like to check its availability for exemption, please contact our Customer Care Team on 020 7501 1101 who will check the availability of the item as a potentially zero-rated product. Claiming VAT Relief Prior to Placing Your OrderIf you are eligible for VAT relief (see below for more details), you can claim VAT relief prior to placing your order. To do this, please follow the steps outlined below. Step One: Select Your Product(s) To start off, simply add whichever products you are interested in buying to your shopping basket. While not all of our products are available with VAT relief, the majority are. Step Two: Choose VAT Relief on the Basket Page Once you are happy that you have everything that you need, you can proceed to the Shopping Basket. In the basket, underneath the name of applicable products, there is a tick-box that allows you to claim VAT relief (please see the example below). Once this box has been selected, the VAT will automatically be removed from your order.

IMPORTANT: If you are buying multiple items, please be aware that you will have to select the VAT relief checkbox for each separate item. Step Three: Fill in Your VAT Relief Form Once you have selected your products and confirmed that you would like VAT relief, you can now continue to the checkout. After entering your personal and delivery details on the first page of the checkout, you will then be directed to a page featuring a form to complete in order to claim VAT relief. Once this form is completed, simply continue to the payment page and place your order (please note this process may differ when checking out via PayPal). IMPORTANT: Please take care when completing the VAT form, as errors or missed fields can delay the dispatch of your order. Claiming VAT Relief After Placing Your OrderIf you have placed an order without claiming VAT relief during the checkout process, you are still able to make the claim afterwards. To do this, please fill in the VAT exemption form below. You are able to do this by either filling in the fields of the form below, or by downloading and printing off the VAT relief form in paper form, completing it and sending it to us. We would recommend filling in the electronic form below as it is quicker and and easier to complete than printing off, completing and return the paper form to us. Please only submit either the electronic form (recommended), or the postal form. There is no need to submit both. Alternatively, please print out this form: VAT Relief FormPlease click on the link below to access the VAT Relief Form.

Please print out the form and send the completed form to us by post at the following address: Amplified Telephones We will process the electronic or postal form upon receiving it, and we will make a refund of VAT to your account, normally within 3 working days. Please only submit one form to us (electronically or via the post). There is no need to submit an electronic and postal VAT relief form. Your are able to check that VAT relief was applied successfully at checkout by reviewing the invoice sent to you by email. If you have any questions about this process at any time, or would like further guidance, please contact our Customer Care Team on 020 7501 1101. They will be happy to assist you with any queries or questions you may have. Who Can Claim Relief from VAT?If you are disabled or have a chronic medical condition, you are eligible to claim relief from VAT – there is no need to register with HM Revenue and Customs. Simply fill in the VAT Relief Form and return it to us at the above address. A detailed explanation of the rules surrounding who is eligible to claim relief from VAT is available from the HM Revenue and Customs website. The document is entitled VAT Reliefs For Disabled People. The reference for this document is Notice 701/7 (August 2002) page. To go directly to this page to view the detailed guidelines, please click here. Can I Claim VAT Relief on Behalf of Someone Else?Yes, however the person that you are claiming on behalf of must be disabled or have a chronic medical condition in accordance with the guidance notes available on the HM Revenue and Customs website (please see above). When claiming on behalf of another, please state your name and contact telephone number alongside the name of person claiming the relief who has a disability or chronic medical condition. Simply fill in the electronic form below by entering the required information into each of the fields. Then submit the form by clicking the "Submit form" button. Our team will process your request as soon as they can. Alternatively, please click on the link below, and complete and return the VAT Relief Form to us by post.

How Will the VAT Be Refunded?When purchasing the goods from our website, www.amplifiedtelephones.co.uk, the full amount including VAT will be charged unless you have claimed VAT relief when placing your order (please see above). If you wish to claim back VAT after placing an order, please complete and return the VAT Relief form to us at your convenience. As soon as we receive the form, we will process the information, and a refund of the 20% VAT that you have been charged will be automatically refunded to your account. This is normally processed within 3 business days. If you have any queries about the refund, or the amount to be refunded, please contact our Customer Care Team on 020 7501 1101. They will be happy to assist you with any queries or questions you may have. How Much Will Be Refunded?The full 20% VAT will be refunded on the item, subject to a completed and eligible VAT Relief Form. The refund will be calculated as follows: Example 1: An item is £120.00 on our website (inclusive of VAT) – this is the purchase price for that item. This £120.00 is calculated as the price of the item exclusive of VAT (£100.00) plus 20% VAT, bringing the VAT inclusive total of the item to £120.00. Once we receive your VAT Relief Form, we will refund you the difference between the price inclusive of VAT, and the price exclusive of VAT: £120.00 - £100.00 = £20.00. We will therefore deduct (or refund) £20.00 (the 20% VAT that was paid on the item). Example 2: An item is £100 on our website (inclusive of VAT). This £100 is calculated as the price of the item exclusive of VAT (£83.33) plus 20% VAT, bringing the VAT inclusive total of the item to £100. If you claim VAT relief prior to placing your order we will deduct £16.77 from your order total. If you claim back VAT after placing your order, we will refund you £16.77. I Can't Find The Answer To My Question HerePlease contact our Customer Care Team on 020 7501 1101 for more information. We will be happy to answer any questions you may have and provide as much information as we can. | |||||||||||